Your Business. Your Legacy. Your Terms.

We help established business owners sell their companies with confidence—to the right buyer, at the right value,

with complete peace of mind.

About Exitvera Capital

Selling your business isn’t just a financial transaction—it’s a personal milestone. At Exitvera Capital, we understand the gravity of that decision.With over 50 years of combined experience in corporate banking and M&A advisory, we’ve guided countless business owners toward successful, stress-free exits. Our approach blends strategic precision with human understanding, helping you unlock maximum value while preserving your legacy.

We act as your dedicated partner—an extension of your team—guiding you from your first valuation to the final handshake.

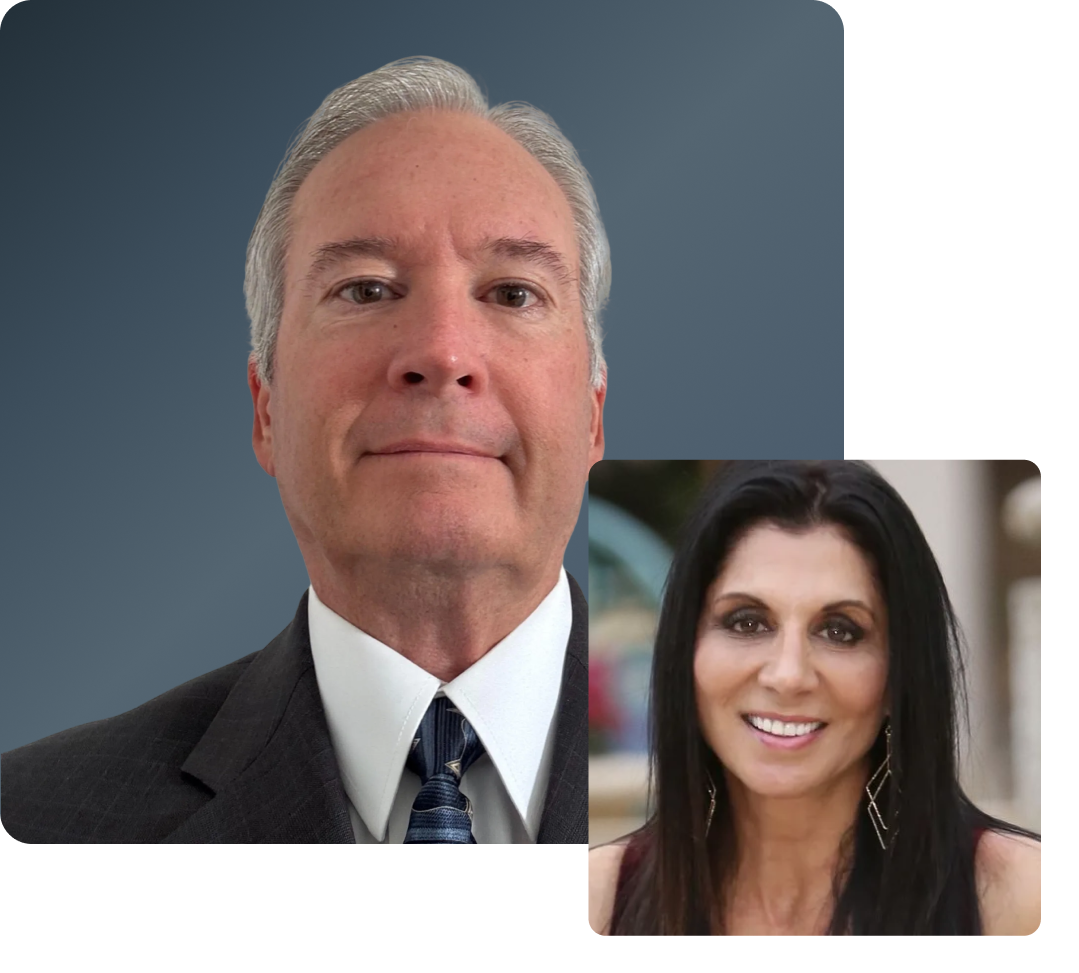

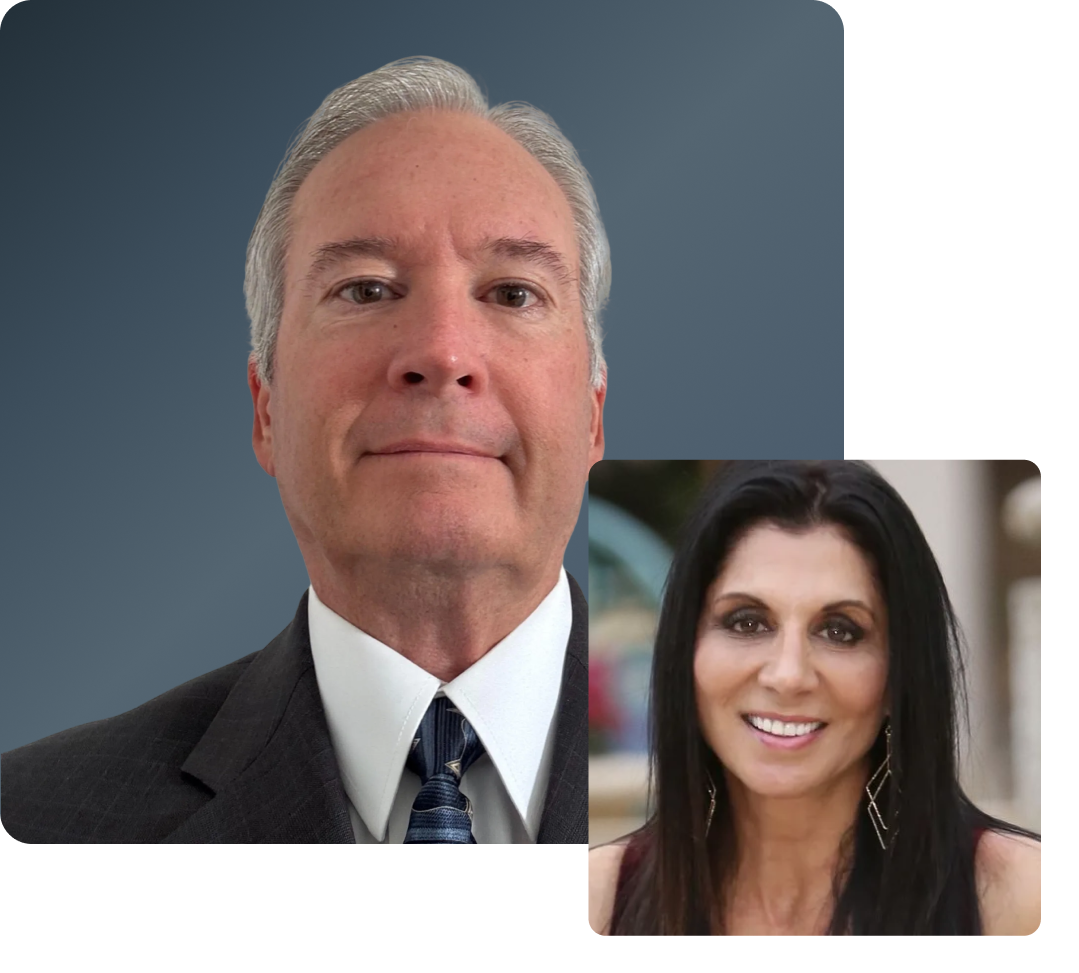

Meet the Partners

Flavia Milano — Managing Partner

A seasoned corporate banker with 18 years at JPMorgan Chase, Flavia brings deep expertise in deal structuring, corporate finance, and business valuation. She’s known for delivering institutional-quality advisory with a boutique,

personal touch.

Flavia holds a B.S. in Economics from Long Island University and has launched and scaled multiple successful ventures.

Meet the Partners

Steve Barnette — Managing Partner

With over 30 years of hands-on experience and more than 200 successful exits, Steve brings the mindset of both an operator and a strategist. After serving as an Army officer, he built, bought, and sold businesses across industries—manufacturing, real estate, senior care, and beyond. His real-world insight helps clients anticipate buyer priorities and navigate negotiations with confidence.

Meet the Partners

Flavia Milano — Managing Partner

A seasoned corporate banker with 18 years at JPMorgan Chase, Flavia brings deep expertise in deal structuring, corporate finance, and business valuation. She’s known for delivering institutional-quality advisory with a boutique,

personal touch.

Flavia holds a B.S. in Economics from Long Island University and has launched and scaled multiple successful ventures.

Meet the Partners

Steve Barnette — Managing Partner

With over 30 years of hands-on experience and more than 200 successful exits, Steve brings the mindset of both an operator and a strategist. After serving as an Army officer, he built, bought, and sold businesses across industries—manufacturing, real estate, senior care, and beyond. His real-world insight helps clients anticipate buyer priorities and navigate negotiations with confidence.

Our Proven Exitvera Process

1. Discovery & Valuation

We begin with a deep dive into your business—its numbers, story, and future

potential—to deliver a clear, data-backed valuation that reflects real market worth.

2. Value Enhancement

Before going to market, we identify ways to strengthen your business’s appeal—optimizing financials, operations, and positioning to attract premium buyers.

3. Confidential Marketing

Using our national network of strategic buyers, private equity firms, and family offices, we discreetly showcase your business to qualified, serious prospects—without disrupting daily operations.

4. Negotiation & Deal Structuring

We manage every aspect of negotiation—creating competitive tension among buyers to drive up value, while structuring terms that protect your interests.

5. Due Diligence & Closing

From document preparation to final signatures, we ensure a smooth, transparent closing process, coordinating with your legal and financial advisors every step of the way.

Why Choose Exitvera Capital

At Exitvera Capital, we bring together the best of both worlds—corporate banking precision and real-world M&A experience. Our team has spent decades working inside major financial institutions while also owning and selling businesses firsthand. That means we understand every side of the table—how buyers think, what investors value, and what it truly takes to prepare a business for a successful exit.

Because we’ve been business owners ourselves, we know the challenges you face and the effort it takes to build something valuable. We treat every client’s exit as more than just a transaction—it’s your legacy, and it deserves our full attention. That’s why we work with a limited number of clients at a time, ensuring personalized strategy, clear communication, and hands-on support throughout the process.

We also believe in flexibility. Whether you prefer a traditional retainer or a performance-based fee structure, we tailor our engagement to match your goals and comfort level. With national reach and boutique-level service, Exitvera Capital gives you access to qualified buyers across the country while maintaining the dedicated, one-on-one guidance you expect from a trusted partner.

Industries We Serve

We partner with business owners across diverse industries, including:

Manufacturing & Distribution

Business Services

Consumer Products & Retail

Technology & Software

Healthcare & Senior Care

Construction & Trades

Industrial Services

Real Estate & Property Services

Food & Beverage

Agriculture & Equipment

Manufacturing & Distribution

Business Services

Consumer Products & Retail

Technology & Software

Healthcare & Senior Care

Construction & Trades

Industrial Services

Real Estate & Property Services

Food & Beverage

Agriculture & Equipment

If your business generates $3M+ in annual revenue, we can help you plan and execute a successful exit—on your timeline.

The Exitvera Advantage

Built by Business Owners

We’ve owned, operated, and sold companies ourselves. We understand what’s at stake.

Maximized Value

We create buyer competition that drives top-dollar offers.

Complete Confidentiality

Your employees and competitors stay unaware until the time is right.

Full-Service Advisory

From valuation to closing, we handle the details while you run your business.

Aligned Incentives

Our success is directly tied to yours. We only win when you do.

Ready to Explore Your Options?

The best time to start planning your exit is before you need to sell. Whether you're ready to go to market today or exploring your options for the future, we're here to help.

Or call us directly:

+1 (954) 263-7730

Frequently Asked Questions

What types of businesses do you work with?

We partner with profitable companies earning $3M+ in annual revenue across most industries.

How long does the process take?

Most transactions take 6-12 months from initial preparation to closing, though we've successfully closed deals in as few as 3 months when market conditions and buyer interest align. The timeline depends on factors like your industry, business size, market conditions, and how prepared your business is for sale. We'll give you a realistic timeline during our initial consultation.

What are your fees?

Unlike firms that require large upfront retainers, we operate entirely on a performance basis. You don't pay us unless we successfully sell your business—ensuring we're fully invested in achieving the best possible outcome for you.

Is the sale process confidential?

Confidentiality is paramount throughout the entire process. We use blind profiles and require signed NDAs before sharing any identifying information about your business. Your employees, customers, and competitors won't know about the sale unless you choose to tell them.

I’m not ready to sell yet—should I still reach out?

Yes. Many of our most successful clients start the conversation 1-2 years before they're ready to go to market. An early discussion allows us to help you identify value-building opportunities, understand current market conditions, and develop a strategic exit timeline that works for your goals. There's no obligation, and the insights alone can be valuable for your long-term planning.

Exitvera Capital — Helping business owners exit with clarity, confidence, and control.

Quick Links

Resource's

- Industries We Serve

- FAQ’s

- Terms of Services